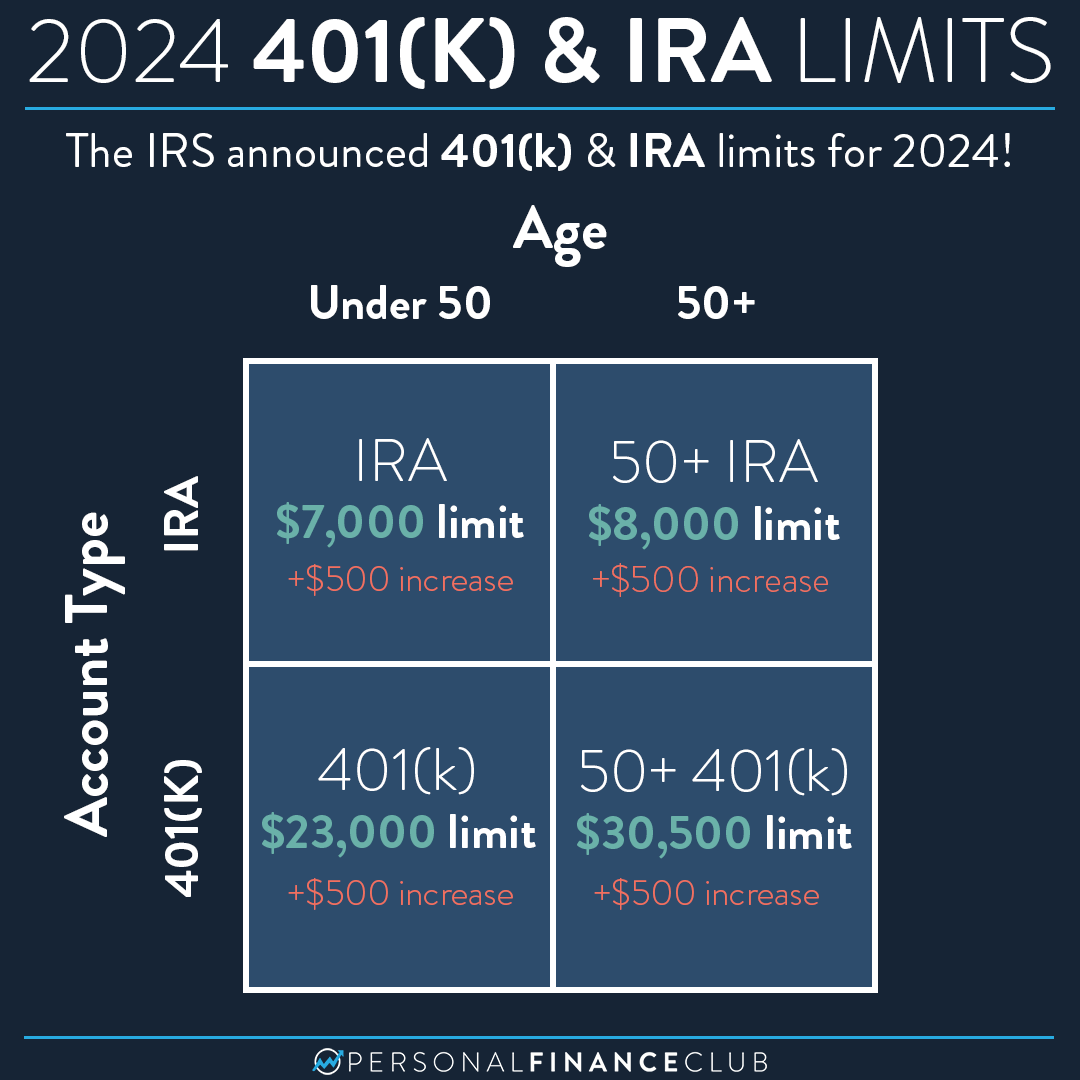

2025 Ira Contribution Limits Catch Up Over 50. The 2025 ira contribution limit remains $7,000, the same as in 2024. Ira contribution limits remain unchanged.

The ira contribution limits for 2025 are the same as for 2024. The first allowable annual contribution was $1,500;

2025 Ira Contribution Limits Catch Up Over 50 Images References :

Source: adrianbshalna.pages.dev

Source: adrianbshalna.pages.dev

Ira Contribution Limits 2024 Catch Up Limits Heda Pearle, Maximum simple ira contribution limits:

Source: williamshort.pages.dev

Source: williamshort.pages.dev

2025 Ira Limits Irs William Short, Maximum simple ira contribution limits:

Source: hannahvjillayne.pages.dev

Source: hannahvjillayne.pages.dev

2024 Roth Ira Contribution Limits Catch Up Contribution Limits Chloe, Savers over 50 may contribute an additional $1,000, also the same as in 2024.

Source: elvinahjkjuanita.pages.dev

Source: elvinahjkjuanita.pages.dev

Ira Limits 2025 Over 50 Tamar Anestassia, The limit on annual contributions to an ira remains $7,000.

Source: torihjkannmarie.pages.dev

Source: torihjkannmarie.pages.dev

2025 Simple Ira Contribution Limits Catch Up 2025 Adore Marcelia, The limit on annual contributions to an ira remains $7,000.

Source: dannyhjksondra.pages.dev

Source: dannyhjksondra.pages.dev

Roth Ira Contribution Limits 2025 Catch Up Viva Catherine, The annual contribution limit for iras remains at $7,000 for 2025.

Source: glorihjkardelle.pages.dev

Source: glorihjkardelle.pages.dev

Simple Ira Contribution Limits 2025 Over 50 Married Berni Marsha, Savers over 50 may contribute an additional $1,000, also the same as in 2024.

Source: jessevbernadette.pages.dev

Source: jessevbernadette.pages.dev

2025 Ira Limits Contribution Over 50 Judye Marcile, You can contribute a maximum of $7,000.

Source: nolieasenanine.pages.dev

Source: nolieasenanine.pages.dev

2025 Roth Ira Contribution Limits With Catch Up Jilly Marlene, Ira contribution limits remain unchanged.

Source: caraaseandriana.pages.dev

Source: caraaseandriana.pages.dev

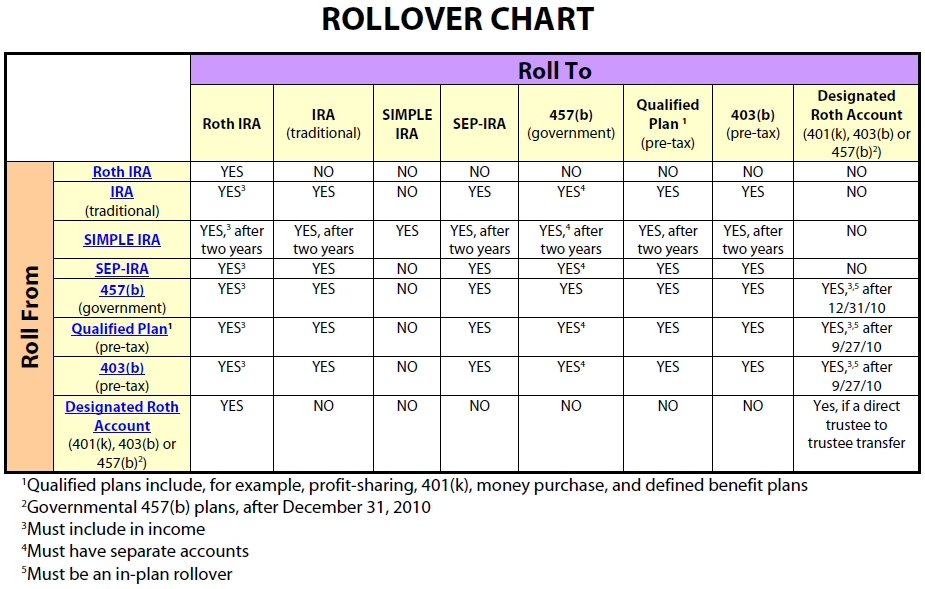

2025 Ira Contribution Limits Junie Margret, Employee and employer deferrals into 457(b) plans:

Posted in 2025