Iira Income Limits 2024 Irs. The 2024 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older. This revenue procedure modifies section 7 of rev.

Beginning in 2024, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for. In 2024, you can contribute up to $7,000 to a.

Iira Income Limits 2024 Irs Images References :

Source: amitieyconstantia.pages.dev

Source: amitieyconstantia.pages.dev

Simple Ira Limits 2024 Irs Jayne Tiffanie, The contribution limit for a roth ira is $7,000 (or $8,000 if you are over 50) in 2024.

Source: shandywtandi.pages.dev

Source: shandywtandi.pages.dev

2024 Ira Limits Karin Marlene, Ira contribution limit increased for 2024.

Source: jadatheodora.pages.dev

Source: jadatheodora.pages.dev

Ira Limits 2024 Donny Lorianna, Is your income ok for a roth ira?

Source: libbyqroxanna.pages.dev

Source: libbyqroxanna.pages.dev

Traditional Ira Limit 2024 Tami Zorina, The contribution limit on individual retirement accounts will increase by $500 in 2024, from $6,500 to $7,000.

Source: fallonyannabelle.pages.dev

Source: fallonyannabelle.pages.dev

Traditional Ira Contribution Limits 2024 Irs Ranee Casandra, This table shows whether your contribution to a roth ira is affected by.

Source: jadatheodora.pages.dev

Source: jadatheodora.pages.dev

Ira Limits 2024 Donny Lorianna, Beginning in 2024, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for.

Source: darrowwealthmanagement.com

Source: darrowwealthmanagement.com

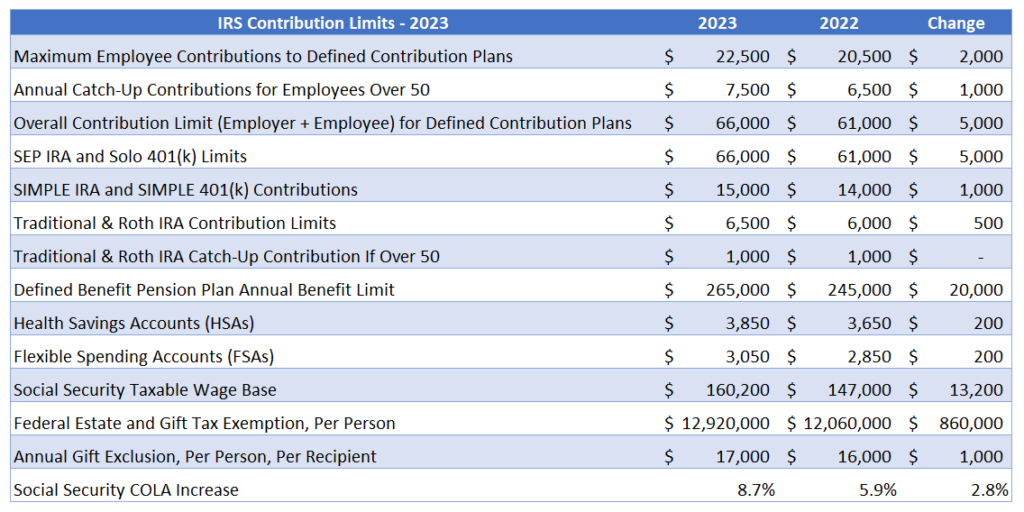

2024 IRS 401k IRA Contribution Limits Darrow Wealth Management, If you are 50 and older, you can contribute an additional $1,000 for a total of $8,000.

Source: beckaywillamina.pages.dev

Source: beckaywillamina.pages.dev

Ira Limits 2024 Single Tami Elenore, For 2024, the ira contribution limit is $7,000 for those under 50.

Source: reinemorgan.pages.dev

Source: reinemorgan.pages.dev

Roth Ira Contribution Limits 2024 Irs Bibi Victoria, A roth ira allows you to contribute $6,500 for 2023 and $7,000 for 2024.

Source: ashleighwdalila.pages.dev

Source: ashleighwdalila.pages.dev

Ira Contribution Limits 2024 Limits 2024 Ailyn Atlanta, Find out if you can contribute and if you make too much money for a tax deduction.

Posted in 2024